extended child tax credit 2025

Participants are eligible for a 6 Excelsior child care services tax credit for ongoing net child care expenditures provided. It was set to expire in 2022.

Stimulus Checks Update Proposal Pushes To Extend The Child Tax Credit Until 2025 Pennlive Com

2016 2019.

. US politicians presented the First-Time Homebuyer Act of 2021 on April 28 2021. The Child Tax Credit is given to taxpayers for each qualifying dependent child who is under the age of 17 at the end of the tax year. Advance child tax credit payments.

That limit was increased again. Read on to learn more about ITIN and the Child Tax Credit. The TCJA doubled the child tax credit CTC from 1000 to 2000 for those who qualify including parents with higher incomes than in the past.

And then when Trump signed the Covid-19 relief at the end of December 2020 it extended this benefit through 2025. Specifically parents with a qualifying child under the age of 17 for whom the parents are allowed a Sec. Owners of new commercial solar.

Eligible families including families in Puerto Rico who dont owe taxes to the IRS can claim the credit through April 15 2025 by filing a federal tax returneven if they dont normally file. 009 child care program credit 011 capital investment credit 111 plastics and rubber manufacturers credit 012 family independence payments credit. Since its inception in 1997 this has been the year the child tax credit has brought the most relief to the most families.

Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes. The 2021 Child Tax Credit is up to 3600 for each qualifying child. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

The tax credit remains at 30 per cent of the cost of the system. The tax credit is equivalent to 10 of the purchase price of your home and cannot exceed 15000 in 2021. Child Tax Credit.

151 dependency deduction are eligible for the child tax credit CTC and working parents who pay for the care of a qualifying child under age 13 are eligible for the child and dependent care credit CDCC. Currently its a 1000 nonrefundable. But while it hasnt gotten as much attention as the relief stimulus checks the CARES Act has temporarily made employer student loan assistance payments tax-free through the end of 2020.

Child Tax Credit. For tax years 2022 through 2025. Child Tax Credit Increased.

While many of these temporary provisions are relatively minor some. General tax credit questions. For home equity debts incurred after December 15 2017 you cannot deduct interest on the debt on 2018-2025 Tax Returns unless it is used to buy build or improve your home that secures the debt.

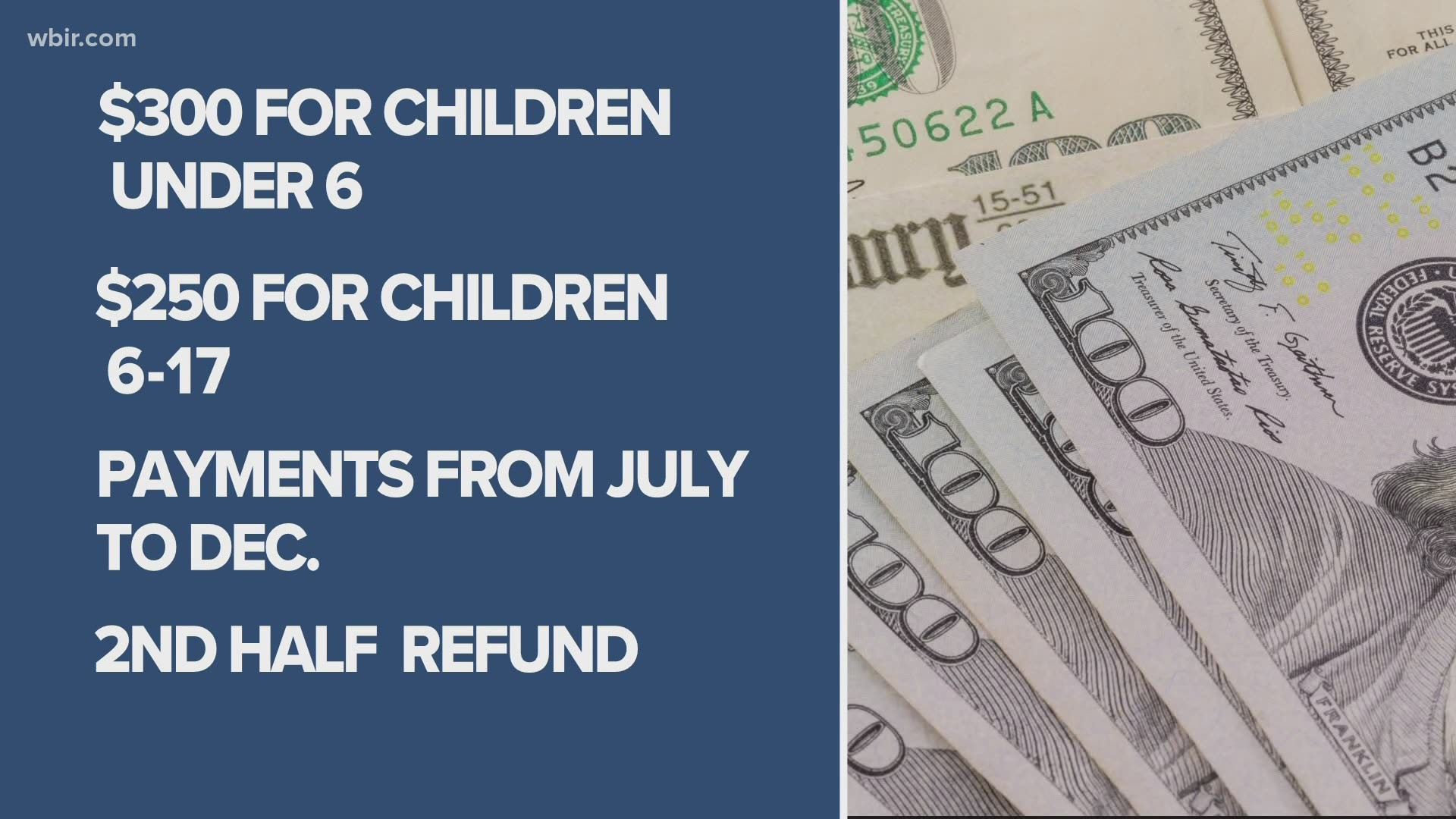

The itemized deduction standard for childrens education fee is RMB 1000 a child per month this can be a much smaller amount than the foreigners actual expenses for childrens. All indications are that the increased child tax credit will be made permanent or at least extended through 2025. The advance child tax credit payments were early payments of up to 50 of the estimated child tax credit that taxpayers may properly claim on their 2021 returns.

The Build Back Better. Under this credit the more a participant covers of ongoing employee child care services. Under the TCJA personal and dependent exemptions are eliminated from 2018 through 2025.

The Empire State musical and theatrical production credit has been extended through tax year 2025. The recently passed Tax Cuts and Jobs Act TCJA added numerous temporary provisions to the tax code which can be hard to keep track of. Due to federally declared disaster in 2017 andor 2018 the IRS will allow affected taxpayers an extended filing date.

This rule is effective for tax years 2018 through 2025. From July through December 2021 advance payments were sent automatically to taxpayers with qualifying children who met certain criteria. Thankfully the Joint Committee on Taxation JCT recently put out an overview on all expiring and already expired tax provisions between 2016 and 2027.

Still many families have questions about how the child tax credit works in 2021. The measure amends the IRS tax law to provide up to 15000 in. Chinas IIT preferential policy allowing some non-taxable fringe benefits for expatriates is extended till the end of 2023.

Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes. For more information see. Your interest deduction is limited to the 750000 Married Filing Jointly and 375000 Married Filing Separately debt amounts.

The Advance Child Tax Credit Changes Coming

Child Tax Credit Is A Critical Component Of Biden Administration S Recovery Package Itep

How To Structure A Permanent Child Tax Credit Expansion

Child Tax Credit 2022 Update 750 Payments Available To Americans But You Have To Apply Soon Deadline Date Revealed

With Child Tax Credit The Us Still Lags Child Allowances Globally Quartz

4 Ways Lawmakers Are Proposing To Reduce Child Poverty Support Families Forbes Advisor

Child Tax Credit 2022 How To Receive Your Payments Next Year Marca

Child Tax Credit 2022 Will Ctc Payments Finally Be Extended Marca

Child Tax Credit 2022 What Will Be Different With Your Payments Next Year Marca

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit You Can Opt Out Of Monthly Payment Soon Abc10 Com

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

New Child Tax Credit Tool Makes It Easier To Sign Up For Payments Here S How Nextadvisor With Time

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

Child Tax Credit 2022 What Changes Will There Be In The New Tax Season As Usa

Ask Gusto Do I Qualify For The Work Opportunity Tax Credit Work Opportunities Tax Credits Tax

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Tax Day Deadline In 3 Weeks What Happens If You File A Tax Extension Tax Extension Tax Refund Filing Taxes

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times