high iv stocks meaning

Implied volatility is a measurement of how much a security will move up or down in a specific time period. A high SV may mean that the underlying security has been going up and down rapidly over a period of time but it may not have actually moved very far from its original price.

:max_bytes(150000):strip_icc()/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

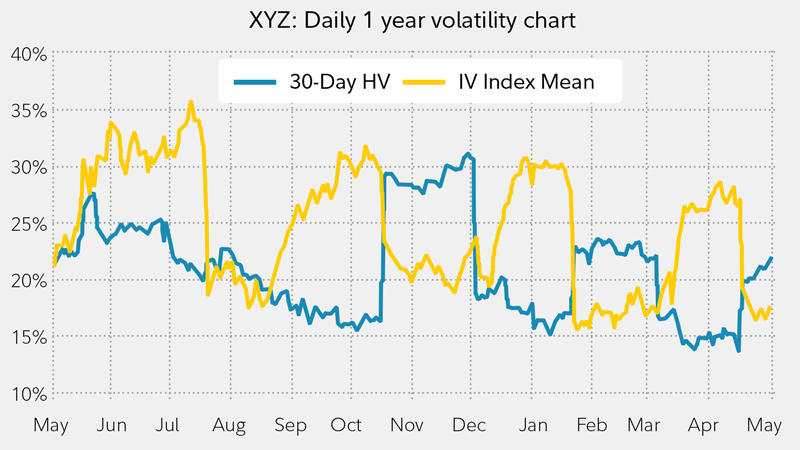

Even more the 30 IV stock might usually trade with 20 IV in which case 30 is high.

. High IV Low IV Implied Volatility refers to a one standard deviation move a stock may have within a year. The IV drop depends mainly on the earnings results. Stock price above or equal to 5 Market capitalisation above or equal to 1 billion Current implied volatility above or equal to 80 High IV Options Trading The scanner is useful if you plan on trading options using popular Theta Gang strategies such as The Wheel and the Cash-Secured Put or even Vertical Spreads.

If the implied volatility is high the market thinks the stock has potential for large price swings in either direction just as low IV implies the stock will not move as much by option expiration. The level of the implied volatility of an option signals how traders may be anticipating future stock movements. Short Iron Condors.

Highlights heightened IV strikes which may be covered call cash secured put or spread candidates to take advantage of inflated option premiums. Implied volatility isnt the same as historical volatilityalso known as. The term implied volatility refers to a metric that captures the markets view of the likelihood of changes in a given securitys price.

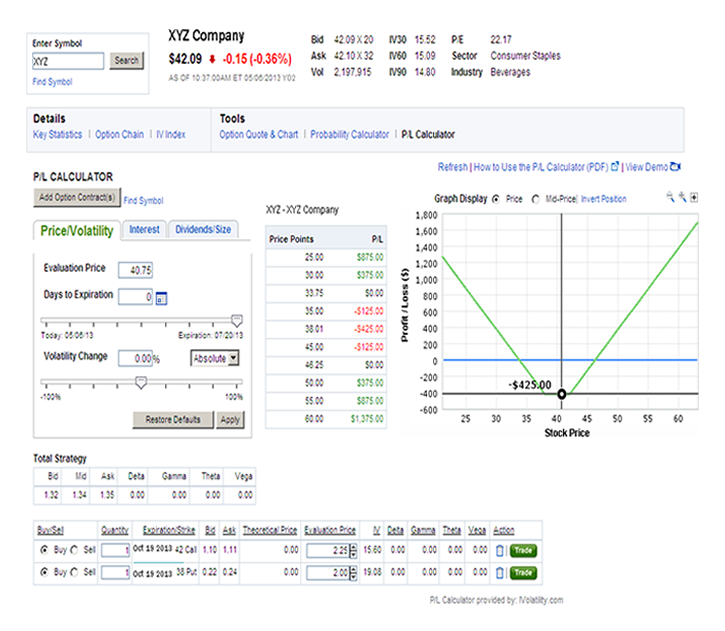

Investors can use implied volatility to project future moves and supply and demand and often employ it to price options contracts. It is a percentile number so it varies between 0 and 100. By understanding both IV and IV rank you can determine the.

Learn how Implied Volatility IV can be a valuable tool for options traders to help identify stocks that could make a big price move. An IV of 20 means that there is a 68 chance 1 SD this 100 stock will move 20 on either side in a year which is. Sat May 7th 2022.

Then the IV of options on Company X stock could be very high as there would probably be an expectation that the price of Company X stock would move a lot when the. Put simply IVP tells you the percentage of time that the IV in the past has been lower than current IV. Highest Implied Volatility Options.

IV crush is the phenomenon whereby the extrinsic value of an options contract makes a sharp decline following the occurrence of significant corporate events such as earnings. High implied volatility would either mean that the options implied volatility is at the high end of its normal range of values or that it is high relative to the actual volatility of the underlying instrument. The lower the IV is the less we can expect.

IV rank or implied volatility rank is a metric used to identify a securitys implied volatility compared to its Implied Volatility history. Unfortunately this implied volatility crush catches many options trading beginners off guard. How much does IV drop after earnings.

An IV of 50 means that the market expects a volatility of 50 until option expiration. What About Options Contracts That Expire in Less Than a Year. Talking about an option for a stock with a price per share at 100 indicates that the market expects -50 price movements per share.

Implied volatility is basically an estimated price move of a stock over the next 12 months. If a stock is 100 with an IV of 50 we can expect to see the stock price move between 50-150. For example one stock might have an implied volatility of 30 while another has an implied volatility of 50.

IV Rank is the at-the-money ATM average implied volatility relative to the highest and lowest values over the past 1-year. If IV Rank is 100 this means the IV is at its highest level over the past 1-year. Displays equities with elevated moderate and subdued implied volatility for the current trading day organized by IV percentile Rank.

Most likely it means the former. IV is the reason two stocks trading at 100 will have completely different option prices for the same strike and expiration. To option traders implied volatility is more important than historical volatility because IV factors in all market expectations.

With stock options this period will be the life of the contract ie until the options contract expires. In simple terms its an estimate of expected movement in a particular stock or security or asset. A high IVP number typically above 80 says that IV is high and a low IVP.

All stocks in the market have unique personalities in terms of implied volatility their option prices. Options professionals might use it in the later sense. What is a high IV.

IV percentile IVP is a relative measure of Implied Volatility that compares current IV of a stock to its own Implied Volatility in the past. An options strategy that looks to profit from a decrease in the assets price may be in order. Stocks and Implied Volatility.

By its nature as a predictive measure implied volatility is theoretical. In this type of market implied volatility is likely to increase. As the implied volatility rank is very high close to the maximum of 100 it means that the option is in fact expensive when its historical implied volatility is taken into account.

In a nutshell its usually better to sell options when the implied volatility is high and buy options when the implied volatility is low. A high IV for one stock might not be a high IV for another stock. Options serve as market based predictors of future stock volatility and stock price outcomes.

54K views View upvotes Quora User. Posted on May 1 2020 by Ali Canada - Options Trading Stock Market Training. A high IV tells us that the market is expecting large movements from the current stock price over the next 12 months When equity prices decline over time Its called a bearish market which is riskier for long-term bullish investors.

Definition and Examples of Implied Volatility. The implied volatility is high when the.

Which Stocks Have The Highest Option Premium Power Cycle Trading

Which Stocks Have The Highest Option Premium Power Cycle Trading

Which Stocks Have The Highest Option Premium Power Cycle Trading

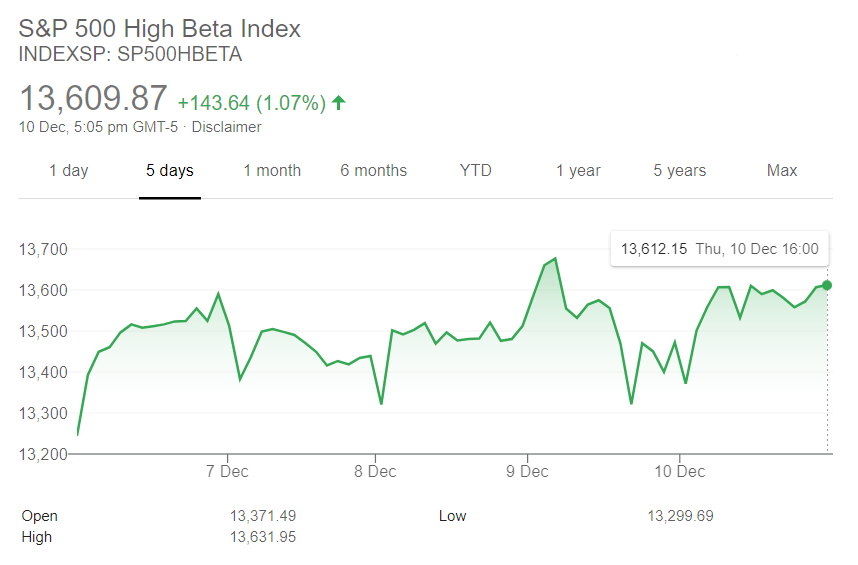

High Beta Index Overview How Beta Works Attractiveness

3 Safe Option Strategies Better Than Stock Buying New Academy Of Finance

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

What Is Volatility Definition Causes Significance In The Market

:max_bytes(150000):strip_icc()/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-02-289fe05ed33d4ddebe4cbe9b6d098d6b.jpg)

The Volatility Index Reading Market Sentiment

Take Advantage Of Volatility With Options Fidelity

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

Volatility Smile Definition And Uses

Take Advantage Of Volatility With Options Fidelity

Pokemon Go Appraisal And Cp Meaning Explained How To Get The Highest Iv And Cp Values And Create The Most Powerful Team Eurogamer Net

/ImpliedVolatility_BuyLowandSellHigh2-2f5a33f6dde64c808b4d4775a258d3d7.png)

Implied Volatility Buy Low And Sell High

/dotdash_Final_The_Volatility_Index_Reading_Market_Sentiment_Jun_2020-01-ee4f3ae7447541368fd404e8bf9e987e.jpg)

The Volatility Index Reading Market Sentiment

:max_bytes(150000):strip_icc()/dotdash_INV_final-Profiting-From-Position-Delta-Neutral-Trading_Feb_2021-02-5e3940a27b30422bb071e5a53f386d05.jpg)

Profiting From Position Delta Neutral Trading

Trading Pro System Stock Options Trading Options Trading Strategies Option Trading

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)

/dotdash_Final_Use_Options_Data_To_Predict_Stock_Market_Direction_Dec_2020-01-aea8faafd6b3449f93a61f05c9910314.jpg)